FINANCIAL ADVISING FOR BUSINESS

This service is designed to empower business owners with the financial knowledge and tools needed to make informed decisions and achieve sustainable growth. By addressing critical aspects of financial planning, budgeting, and analysis, entrepreneurs will gain a deeper understanding of how to strategically manage their finances. From crafting solid business cases to refining financial models, participants will learn methods to optimize resource allocation and drive profitability. Moreover, the program offers guidance on accessing capital, navigating tax matters, and exploring insurance options, ensuring businesses are equipped with the foundational support to thrive in a competitive marketplace. Through expert orientations and referrals to specialized professionals, this service underscores its commitment to fostering the financial well-being of businesses in the Hispanic community

SCOPE:

Hispanic Workforce can provide general information and refer clients to resources and specialists to assist them in the following areas:

- Financial Planning and Analysis: Best practices and how to use it for decision-making.

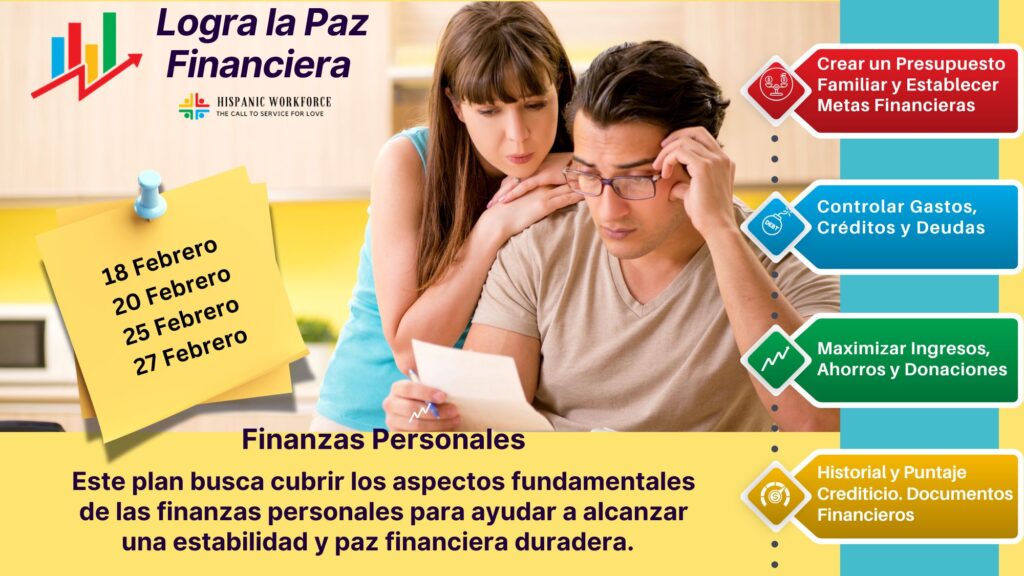

- Budgeting: For planning and managing their business and personal finances.

- Business Cases: Main components of a solid business case and how to develop one.

- Financial Modeling: Business modeling building and refining of existing models.

- Capital Sourcing: Orientation on the different options for accessing capital, including loans and investments, and referral to financial institutions and specialized capital providers.

- Financial Accounting: Orientation on Accounting Principles based bookkeeping and financial reporting to manage the business and compliance with general regulations.

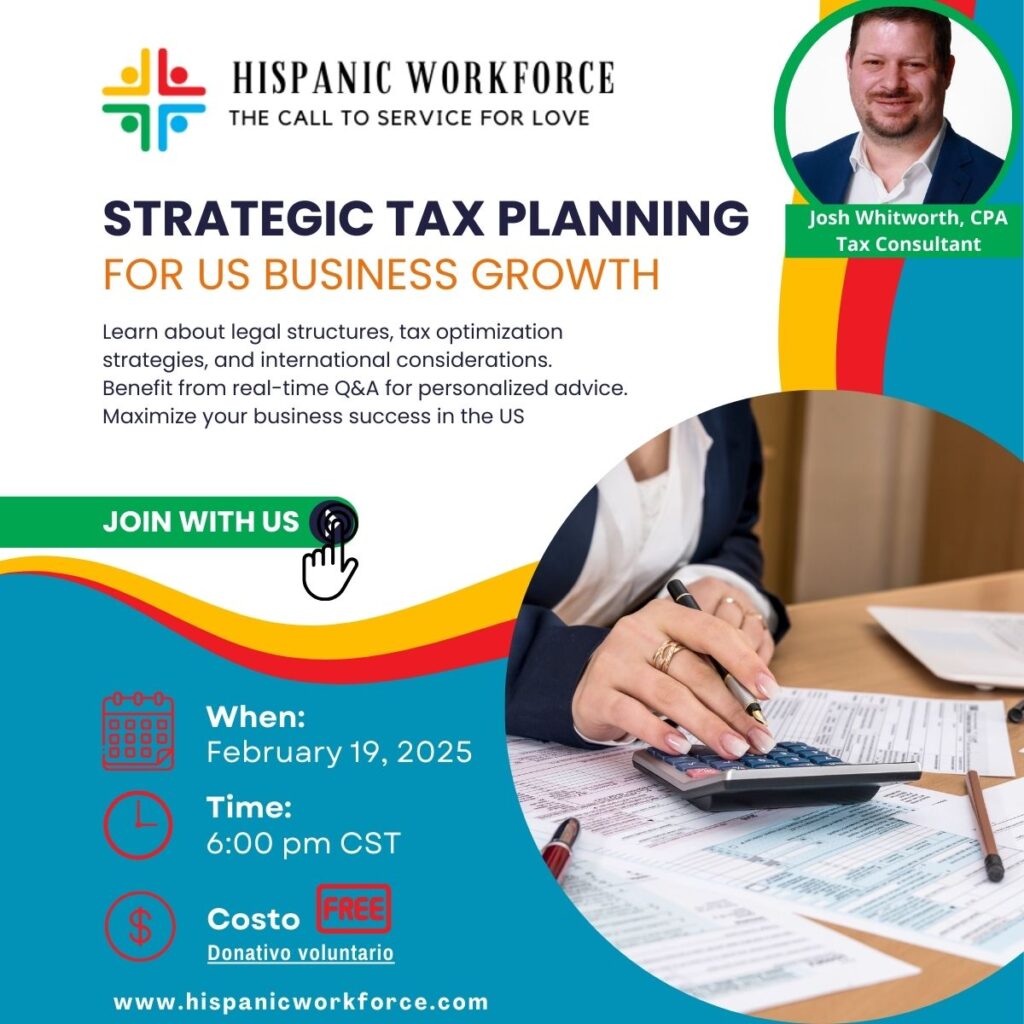

- Taxes: Provide general information on tax matters and reference to tax advisors.

- Insurance: Overview of insurance options and reference to specialized agents.

BENEFIT:

This service empowers Hispanic entrepreneurs by enhancing financial literacy and providing access to key resources. Participants can make informed decisions, optimize resources, and ensure business sustainability in a competitive market.

Referrals to specialists save time and connect business owners to expertise in areas like capital sourcing, tax compliance, and insurance planning, helping mitigate risks and drive growth.

Overall, the program equips entrepreneurs with the knowledge and strategies needed to thrive while contributing to community prosperity.